Pipestone Resources

SwineTime Podcast

Created for individual pork producers, SwineTime, hosted by Pipestone veterinarian Dr. Spencer Wayne, offers industry news, advancements in animal care, and tips for boosting productivity.

Articles

Featuring expert insights on health, management, nutrition, business, and research, the articles provide valuable knowledge to help pig farmers enhance their operations and stay ahead in the industry.

Evolving for the Farmer: The Legacy of Hiawatha

Standing in the Gap: How Public Perception Can Drive Real Change in Swine Welfare

2025 Health Outlook

Biosecurity at the Feed Mill: A Critical Step in Disease Prevention

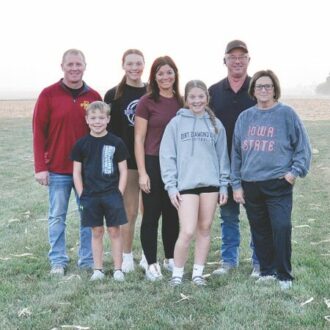

Customer Stories

We’re proud to work with the dedicated farmers who are the backbone of the swine industry every day. These stories highlight their dedication, passed down through generations, and their unwavering commitment to the future of farming for many more to come.

Pursuing Growth at Wincreek Farms

Weber Farms: Honoring Tradition While Embracing Growth

Jeff & Nancy Lucas: A Legacy of Collaboration, Partnership, and Excellence in Farming

Providing Solutions for Independent Pork Producers

Employee Spotlight

Join us in celebrating our team members who consistently embody our core values and are committed to achieving our mission of Helping Farmers.

Dr. Bryan Myers Honored as Swine Practitioner of the Year

2024 David Neuberger Award: Samuel Morales Zarate

2024 David Neuberger Award: Lisa Brands

Team Members Exemplify Integrity

Pipestone Journal

The Pipestone Journal is the premiere pork print journal featuring and serving producers just like you. Released quarterly, the Journal provides top-notch, timely information in the areas of health, management, nutrition, and business.

Winter 2025 – Tried & True

Fall 2024 – Pig Care Basics

Summer 2024 – Prioritizing People